This plan, which President Trump endorsed in his State of the Union deal with , allows American households to take a $5,000 advance on their Baby Tax Credit.

tax amnesty dan dasar hukumnya

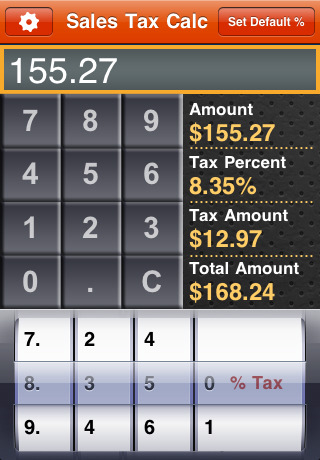

Quickly calculate how much tax you’ll want to pay in your income. As a candidate, Mr. Trump tapped into those sentiments by sometimes promising to raise taxes on the wealthy, although his signature 2017 legislation reduce them as an alternative. Pay for added TurboTax services out of your federal refund: A $39.99 Refund Processing Service price applies to this payment technique.

Quickly calculate how much tax you’ll want to pay in your income. As a candidate, Mr. Trump tapped into those sentiments by sometimes promising to raise taxes on the wealthy, although his signature 2017 legislation reduce them as an alternative. Pay for added TurboTax services out of your federal refund: A $39.99 Refund Processing Service price applies to this payment technique.

Greatest Buy is the most recent main corporation to hand out bonuses to its workers on account of the lately passed company tax reform. Most individuals agree as witnessed by the shortage of political traction for taxes. FirstBank (Longmont, Colorado) – $1,000 bonuses for full-time employees; $500 for half-time employees; base wage raised, wage increases.

Democrats are pushing one other pricey entitlement that may impose onerous mandates on employers and increase taxes on American workers and businesses. Ms. Warren would raise taxes on wealthy people in several other ways. This time, the left is using the issue of paid household depart as an excuse to push this dramatic growth of presidency.

After I saw the increase in take-house pay in all of our paychecks after President Trump’s tax cut implementation, I wrote bonus checks of $500 each to my staff. Lower than rigorous metrics like dollars spent on disasters have no scientific meaning and exaggerate completely normal events into percieved catastrophies, but they’ve actual meaning for enterprise and government.

Planning for future local weather situations cannot fairly be separated from planning for future financial conditions for these companies that are affected by local weather. Fastest refund potential: Fastest tax refund with e-file and direct deposit; actual tax refund time will vary based mostly on IRS.

tax calculator 2020 hmrc

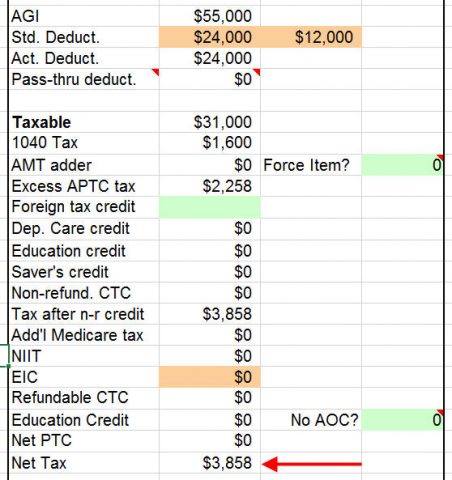

A lot of the candidates would make those households pay extra payroll taxes, to be able to fund an growth of Social Safety advantages. To help fund public works and companies—and to construct and keep the infrastructures utilized in a country—the federal government normally taxes its particular person and corporate residents. Anytime, anywhere: Internet access required; commonplace knowledge rates apply to obtain and use mobile app.

conclusion

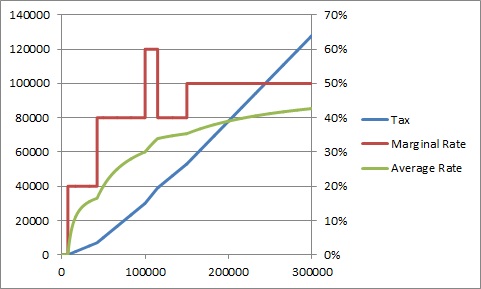

In his 2016 presidential marketing campaign, he called for a 52 p.c high marginal revenue tax price. As well as, she would increase Social Security payroll taxes on high earners and create a new Social Safety tax on their investment revenue.