If in case you have a non-public pension, you do not need the consent of an employer or the pension provider to take advantages early, if the terms and circumstances of your contract will let you do this.

pensions meaning in arabic

Pension Insurance coverage Corporation plc is a specialist UK insurer. Your employer should be capable of present particular guidance on the advantages accessible. It’s where you surrender a few of your month-to-month earnings and your employer places it towards something else – in this case, pension contributions. If you’re still an active member of that scheme, then there’ll in all probability also be a lump sum fee made to your dependants which is often a multiple of your pensionable wage.

Pension Insurance coverage Corporation plc is a specialist UK insurer. Your employer should be capable of present particular guidance on the advantages accessible. It’s where you surrender a few of your month-to-month earnings and your employer places it towards something else – in this case, pension contributions. If you’re still an active member of that scheme, then there’ll in all probability also be a lump sum fee made to your dependants which is often a multiple of your pensionable wage.

You probably have a remark or question about advantages, you have to to contact the federal government division or agency which handles that benefit. With most office pensions, your employer chooses a 3rd-get together pension firm eg, Aviva, but you’ll be able to still decide the kind of risks you wish to take with them.

Particular person benefits – advising trustees, corporations and often individual members on complicated options relating to individuals’ pension advantages. Pensions’ bad rap primarily comes from investments that don’t repay or high fees (see Martin’s weblog: The one phrase that precipitated the pension crisis ).

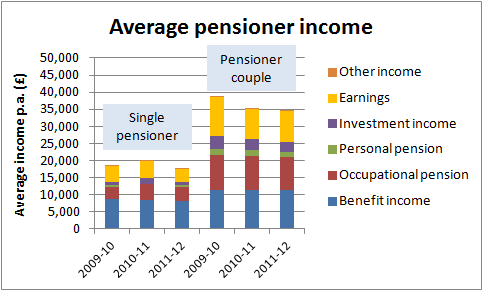

However, not all employers have supplied pensions. A pension scheme is designed to offer you income along with the State Pension The single tier State Pension gives up to £168.60 per week, though you’ll have some additional protected payment as properly.

A key plus of a pension plan is the tax reduction, which is available in two varieties relying on whether or not you are a primary-price or larger-price taxpayer. If you are a member of the scheme in Scotland, see the Scottish Public Pensions Company web site for extra information.

pension plan definitions

The worth of this pot can go up or down but over the long run, pension financial savings usually develop and you can profit from plenty of tax advantages. You want the identify of an employer or a pension provider to make use of the service. You probably have a defined contribution pension scheme, you build up your personal pot of cash. In most cases, your pension scheme will provide benefits on your death.

conclusion

With over 70 years’ expertise, £12 billion of belongings beneath management and over 350,000 members, TPT operates purely for the good thing about its members and employers. As it comes out of your PRE-TAX wage and straight into your pension, you pay less national insurance (NI).