To deposit £one hundred in your pension pot, you solely have to surrender £58 out of your pay packet, as no tax or NI is deducted as a better rate payer.

what is a pension fund trustee

When you have pension advantages coming to you, you are among the many most fortunate, because the variety of conventional pension plans continues to dwindle. While sixteen% of your pay seem a huge dedication, this determine contains your employer’s contribution – so that you only have to fund the remainder. In case you didn’t make National Insurance coverage contributions or get National Insurance coverage credits before 6 April 2016, your State Pension will be calculated fully underneath the brand new State Pension rules.

When you have pension advantages coming to you, you are among the many most fortunate, because the variety of conventional pension plans continues to dwindle. While sixteen% of your pay seem a huge dedication, this determine contains your employer’s contribution – so that you only have to fund the remainder. In case you didn’t make National Insurance coverage contributions or get National Insurance coverage credits before 6 April 2016, your State Pension will be calculated fully underneath the brand new State Pension rules.

For a more correct method of calculating how much it is advisable to retire, try utilizing the Cash Advice Service’s pension calculator It’ll ask for information including whenever you need to retire, how a lot you and your employer are contributing, and whether you need your pension to be inflation-proof.

These whose revenue (excluding pension contributions) is underneath £one hundred ten,000 shall be unaffected by these changes, even if pension contributions take them over £one hundred ten,000. If you would want extra earnings than this, saving right into a pension scheme is sensible.

For most people, accessing pension money at 55 will be too early, so it could just be left where it’s. But if you want to, you may access all your pension money directly – the first 25% is tax-free and the remaining 75% will likely be taxed as revenue.

Nevertheless, not all employers have supplied pensions. A pension scheme is designed to give you revenue in addition to the State Pension The only tier State Pension supplies up to £168.60 every week, though you may have some extra protected cost as well.

pensions regulator declaration of compliance

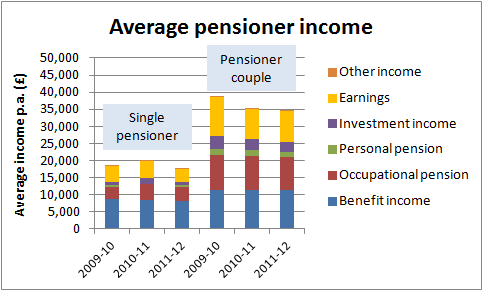

The proportion of adults beneath the State Pension age actively contributing to a non-public pension has elevated since July 2010 to June 2012, from 43% to 53%; this rise reflects increased participation in defined contribution schemes, likely to be a results of the introduction of automatic enrolment between 2012 and 2018. From 6 April 2016, you may be able to get extra State Pension by including qualifying years to your Nationwide Insurance report.

conclusion

The compensation payable to some members of the Academics’ Pension Scheme could also be lower than the authorized charges being quoted, and some members may very well have gained from the adjustments in which case no compensation could be payable.