You might have another 5 qualifying years on your Nationwide Insurance coverage report after 5 April 2016 (each year including about £four.70 a week to your State Pension) equalling £23.48 per week.

what is a pension credit concession

An important advantage of pension schemes is which you could normally start taking cash from them from the age of 55. This is well earlier than you can obtain your State Pension. In an effort to plan to your retirement, it is advisable to determine how much revenue you may get from all your pensions, together with workplace or personal plans, in addition to the State Pension. In the event you’re a member of a workplace pension scheme, you usually require the consent of the employer or ex-employer to take benefits early.

An important advantage of pension schemes is which you could normally start taking cash from them from the age of 55. This is well earlier than you can obtain your State Pension. In an effort to plan to your retirement, it is advisable to determine how much revenue you may get from all your pensions, together with workplace or personal plans, in addition to the State Pension. In the event you’re a member of a workplace pension scheme, you usually require the consent of the employer or ex-employer to take benefits early.

You get some tax again on the cash you put into a pension, whereas gains from the investments you make with that cash are largely tax-free. National Insurance contributions or credit on your National Insurance coverage file before 6 April 2016 can even depend in direction of your new State Pension.

Many stem from a elementary misunderstanding of what a pension plan is. It is simply a tax-sheltered wrapper to economize for retirement. Each qualifying 12 months on your Nationwide Insurance record from 5 April 2016 will add about £4.70 per week to your new State Pension.

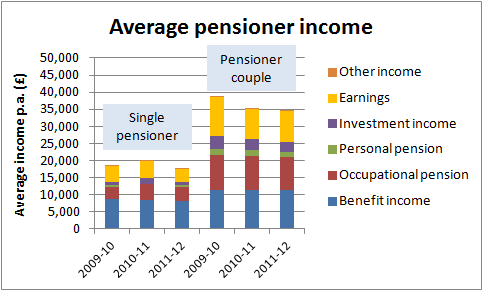

The proportion of adults beneath the State Pension age actively contributing to a non-public pension has elevated since July 2010 to June 2012, from forty three% to 53%; this rise reflects increased participation in defined contribution schemes, more likely to be a result of the introduction of automatic enrolment between 2012 and 2018.

Hypothetical calculations had been introduced to safeguard the position of members who after completing ample service to qualify for retirement advantages, had a break in service after which, at a later date undertook additional pensionable employment.

what is a pension plan in india

Normally with pensions, in case you purchase through a dealer it would not hold any of the cash, it merely acts as a conduit so that you can put the money into whatever funds or investments you want. And the key questions to ask are what type of plan it is (for example, outlined profit or outlined contribution?) and, until it’s a defined profit scheme, which pension supplier your pension is with.

conclusion

You can still use your retirement money to purchase an annuity if you want to, however you not must. The pension freedoms that were launched in 2015 imply that anybody who’s aged 55 or over can take their pension cash however they need, every time they want – there’s now full freedom.