Visit for extra data on workplace and personal pensions For extra info on your specific occupational pension, communicate to your employer’s payroll or human sources department.

pension fund definition economics

NEA is dedicated to defending defined-benefit pension plans because these plans provide a predictable, guaranteed profit. A State Pension statement will provide you with an estimate of how much State Pension you may get, primarily based in your National Insurance contribution data to this point. You can usually open your pension pot at age fifty five and take a tax free money sum out of your pension.

NEA is dedicated to defending defined-benefit pension plans because these plans provide a predictable, guaranteed profit. A State Pension statement will provide you with an estimate of how much State Pension you may get, primarily based in your National Insurance contribution data to this point. You can usually open your pension pot at age fifty five and take a tax free money sum out of your pension.

Auto enrolment now requires employers to supply staff a pension, to mechanically enrol you within the scheme and, crucially, to contribute on your behalf. With these, you get a proportion of your final pre-retirement salary, or when leaving that agency, as an annual revenue.

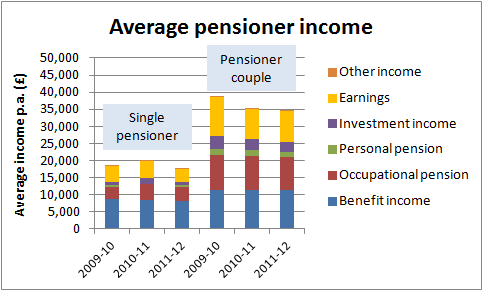

So as to plan to your retirement, that you must determine how much revenue you’ll get from all your pensions, together with workplace or private plans, as well as the State Pension. In the event you’re a member of a workplace pension scheme, you usually require the consent of the employer or ex-employer to take benefits early.

Roughly 360,000 individuals have been given incorrect forecasts of their state pension advantages, the government has confirmed. With auto-enrolment office pensions, there are minimal contribution levels. You must compare the advantages from your current pension with the estimated advantages of your new pension, together with any ensures and penalties.

In case you pay tax at the greater 40% or forty five% rates, salary sacrifice means you do not have to say again the additional tax aid yourself – as you’re by no means taxed on these contributions in the first place – and you do not have the 2% NI deducted on those contributions either.

what is a pension fund uk

In April 2016 to March 2018, nearly half (48%) of all non-public pension wealth was held in pensions in cost, 37% in lively pensions and 15% in preserved pensions; these proportions have been secure over time. And the important thing inquiries to ask are what type of plan it’s (for instance, outlined profit or defined contribution?) and, unless it is a outlined benefit scheme, which pension supplier your pension is with.

conclusion

You will also receive a State Pension once you reach your State Pension age primarily based in your National Insurance record. Auto enrolment now requires employers to supply employees a pension, to automatically enrol you in the scheme and, crucially, to contribute in your behalf.