When you didn’t make National Insurance coverage contributions or get National Insurance coverage credits before 6 April 2016, your State Pension can be calculated entirely under the brand new State Pension guidelines.

what is a pension fund

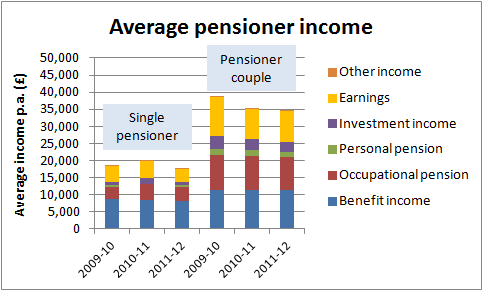

Recommendation and steerage about pensions including information on the most recent pension updates (including the 2019 wage band contribution modifications), pensions recommendation and key documents. Roughly 360,000 folks have been given incorrect forecasts of their state pension benefits, the federal government has confirmed. With auto-enrolment workplace pensions, there are minimal contribution levels. It is best to evaluate the advantages out of your current pension with the estimated benefits of your new pension, together with any ensures and penalties.

Recommendation and steerage about pensions including information on the most recent pension updates (including the 2019 wage band contribution modifications), pensions recommendation and key documents. Roughly 360,000 folks have been given incorrect forecasts of their state pension benefits, the federal government has confirmed. With auto-enrolment workplace pensions, there are minimal contribution levels. It is best to evaluate the advantages out of your current pension with the estimated benefits of your new pension, together with any ensures and penalties.

Your last recorded 12 months of pensionable service earlier than your retirement. Irrespective of how outdated you are, there’s all the time a worth in saving into a pension scheme, particularly in case your employer can also be keen to contribute. We use cookies to gather details about how you use We use this info to make the web site work as well as doable and improve authorities services.

The place a member in the Profession Common association has a Wage Link, which means the salaries earned throughout service in the Career Average arrangement are taken into account to determine the perfect final common salary, the restriction will apply when determining the perfect closing average salary used to calculate benefits in the Final Salary arrangement.

In case you are working in the unbiased sector you’ll have the option to pay right into a pension scheme arranged by your employer that each you and your employer make a contribution into. You need to get your first payment within 5 weeks of reaching State Pension age.

If in case you have no pensionable service on or after 1 January 2007, your common wage will be the greatest one year within the final 1095 days before you left service. In case your nationwide insurance coverage contributions fall short of getting you a full state pension, you can make voluntary top-up contributions.

what is a pension credit canada

When you’re in career average whenever you retire and have last salary benefits then the salaries you have earned in profession average might be used. People saving into a remaining-salary pension scheme who are receiving compensation for past discrimination might end up with large tax payments. You probably have a defined contribution pension scheme, you construct up your personal pot of money.

conclusion

These whose earnings (excluding pension contributions) is underneath £110,000 will probably be unaffected by these changes, even when pension contributions take them over £a hundred and ten,000. Employer pension contributions are set to rise from sixteen.four per cent to 23.6 per cent in September 2019.